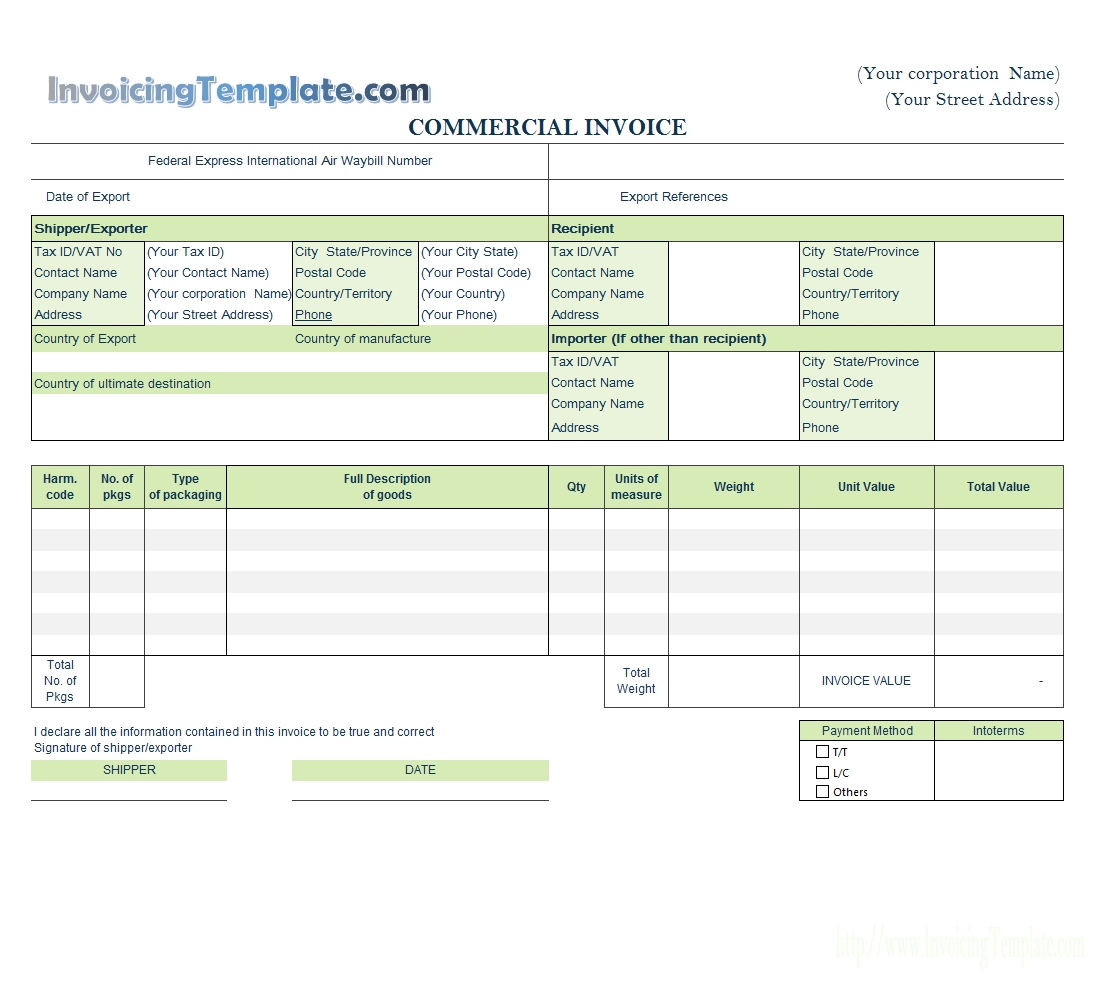

If there is a reference number make sure it is included. Or, if you were providing a service, include a description of the work you did and the fees involved so your customer is clear. List the products you sold, their prices and how many were sold. Make sure you have the correct customer name, contact details and address. Check out for useful information on invoice types If you’re not registered for GST, you don’t need to show these words and your invoice should show that no GST was charged on the purchase. If you are GST registered your invoice should include the words ‘tax invoice’ and you need to include the GST amount for each item along with some extra details.Business name – if you are a sole trader or freelancer you can use your personal name.Not only should it ideally feature your business logo, but there are other important details you need to include:

Your invoice represents your business, so you want it to be as professional looking as possible. If you want to design your own invoice, the Australian Tax Office voluntary standards provide a good guide to what to include and how to lay out the information.

0 kommentar(er)

0 kommentar(er)